The private equity landscape is complex and ever-changing. Yet CFOs and portfolio managers are still expected to provide clear insights, often relying on outdated tools like Excel or siloed data systems.

This can lead to problems that may erode returns, strain investor relationships, and result in missed opportunities during exits.

Traditional methods struggle to manage the multidimensional datasets that characterise modern PE portfolios. From tracking profitability shifts to stress-testing exit scenarios, the stakes are too high to leave these decisions to chance.

This is where the Data Cube comes into play. The Data Cube is a sophisticated reporting tool that enables portfolio managers to examine data from all perspectives. It supports better performance, reduces risk and uncovers valuable opportunities at scale.

At iFD, we help ambitious companies overcome financial challenges. In this guide, we will explain how a data cube enables private equity teams to take a 360-degree view of their entire portfolio, bringing together financial, operational and market data in one place. This empowers teams to make faster, more informed decisions, identify hidden opportunities and drive greater value across their investments. We will also share practical steps to seamlessly integrate this tool into your existing workflow.

What Is the Data Cube?

At its most basic level, a Data Cube is a reporting tool that allows you to view data within a multidimensional framework, organising the data into a structured, interactive format.

It functions like a 3D spreadsheet, enabling you to analyse data from different angles.

For instance, you can examine areas such as time, geography, asset class, or portfolio segment, all from a single view in the same report.

This helps financial teams analyse data on a larger scale, transforming fragmented information into one cohesive narrative. As a result, there is less opportunity for data to become siloed, leading to more unified decision-making based on this data.

If you seek a deeper understanding of the fundamentals, explore our guide: What Is the Data Cube?

The Purpose of Portfolio Monitoring and Management

Private equity portfolio management is about making smart, strategic decisions to generate the best possible returns on investments. This includes setting long-term goals like growth and expansion, tracking performance, reducing risks, identifying and fixing underperforming areas, and planning exit strategies. At every stage, data plays a key role in guiding these decisions and unlocking value.

Core Components Of Effective Private Equity Portfolio Management

At its core, effective private equity portfolio management comes down to four key tasks. These help ensure your portfolio is performing well today and is positioned for future growth, whether that is through smart risk management or a well-timed, profitable exit.

Strategic Oversight

Managing a PE portfolio requires strong leadership to set and track long-term goals. These goals might include entering new markets or diversifying revenue streams to drive business growth.

Operational Efficiency

Most businesses in a portfolio can handle day-to-day operations without major issues. However, are they running as efficiently as possible? Effective portfolio management means regularly reviewing the business to identify inefficiencies, whether in supply chains, labour costs, procurement, or other key areas.

Financial Restructuring

PE portfolios often include a mix of businesses, each with its own financial reporting and processes. Portfolio management ensures these areas are optimised, striking the right balance between debt, equity, and working capital.

Exit Planning

Most successful exits are planned using real-time and accurate data from the business and insights into market trends. It is crucial to have resource dedicated to monitoring these areas to ensure maximum return when the time comes for exit, helping to achieve long-term success and value for the portfolio.

The Problem

Modern PE portfolios have become more complex, and with that, the need for data-driven decisions has increased, along with the challenges that come with them.

Imagine managing 15 companies within a portfolio, each with its own financial data and unique systems. On top of this, you also need to consider:

- Siloed data

- Manual processes

- Blind spots

Data gets trapped in disconnected systems, insights lag behind market shifts, and risks slip through the cracks.

Even worse, inaccurate data can lead to poor, costly decisions.

Tools and Techniques for Effective Portfolio Management

Today’s PE managers must oversee multi-dimensional portfolios, and the most effective ones use modern tools and techniques to improve data clarity, boost profitability, and streamline daily operations.

Real-Time Dashboards

Think of these as key indicators of a private equity portfolio’s health, providing a live feed into the most important KPIs. Real-time dashboards aggregate data from ERP systems, CRMs and market feeds into a single, dynamic view. They help PE managers track critical KPIs, spot trends early, and ensure teams stay aligned with a unified view of performance. Dashboards transform fragmented data into actionable insights that teams can act on immediately, rather than waiting for the next report.

Scenario Analysis Tools

The most volatile factor affecting modern private equity portfolios is the market. Events beyond your control, like market shifts, regulatory changes, or major disruptions, are inevitable. That is why it is crucial to plan and stress-test for these scenarios in advance.

Scenario planning tools enable businesses to test their portfolios against potential “what if” situations, showing how events could impact cash flow, debt, valuation, and overall performance. This helps them build contingency plans and adjust strategies proactively.

Benchmarking Software

Understanding how your portfolio compares to your competitors is crucial. Traditionally, this would require a vast amount of data and manual reporting. However, PE managers can now use benchmarking software that compares performance metrics against industry standards.

This software helps PE managers identify outliers in their portfolios, set realistic targets, and validate the valuations of their businesses, ensuring that exit plans align with current market conditions.

Benchmarking transforms subjective assessments into objective action plans, keeping portfolios competitive.

How Can The Data Cube Benefit Private Equity Portfolio Management

Private equity relies on precision. Every decision, whether acquiring a new company or restructuring a struggling one, requires accuracy, speed, and careful planning. With the Data Cube, you can organise complex data into interactive and accessible reports, empowering teams to improve portfolio management. Below are four key ways it can benefit your business.

Granular Profitability Analysis

Data cubes dissect financial performance across dimensions such as product lines, geographies, customer segments, and time periods. This allows private equity managers to pinpoint precisely where value is created or eroded.

Traditional financial statements provide a flat, aggregated view i.e. “The total revenue of the business is £50M”. Data cubes reveal the story behind the numbers, such as “Which product contributes 80% of the margins?” or “Which region is underperforming due to operational inefficiencies?”

These granular insights enable faster and more informed decisions, allowing you to turn underperformers into profit drivers.

Accelerate The Due Diligence Process

Data cubes pre-structure a target company’s financial and operational data into ready-to-analyse insights. This can potentially eliminate weeks of manual data cleansing for your firm during the acquisition process. Even more importantly, it helps speed up lengthy due diligence processes that risk losing deals to competitors or missing market windows.

For example, if your firm is evaluating and considering the potential acquisition of a new business with multiple locations across several regions, instead of having to manually aggregate data from multiple spreadsheets – a task that may take a significant time – the data cube provides instant insights. This means that you can accelerate the due diligence process and make more informed post-acquisition efficiency plans.

For a detailed step-by-step guide on how to use the Data Cube for PE reporting, read our post.

Risk Mitigation

Data cubes can integrate historical trends, real-time data, and scenario modeling to identify risks such as customer concentration, market volatility, or liquidity shortfalls.

This approach is advantageous since reactive risk management can be expensive. By adopting a proactive stance, you can help preserve value and maintain investor confidence.

For example, if a portfolio company generates a significant portion of its revenue from a single customer segment, the data cube can highlight this concentration risk, suggesting that the PE team may need to diversify into new markets or customer segments.

Exit Strategy Optimisation

Data cubes enable private equity firms to present buyers with multi-year financial trajectories that instil confidence in a company’s future performance.

By organising financial data such as product lines, customer segments, and growing geographies, you can showcase recurring revenue streams and growth opportunities for the business, which is key when securing premium valuations.

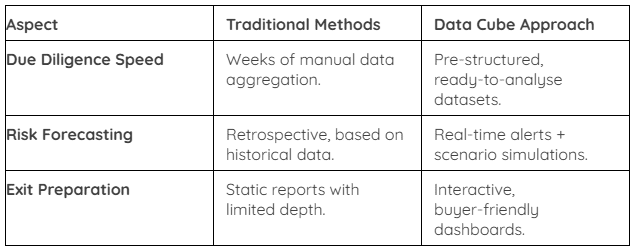

The Data Cube vs Traditional Analysis

How You Can Integrate The Data Cube Into Your Portfolio Management

Integrating Data Cubes into your private equity workflow does not require a full overhaul of your current systems; it enhances them. Here is how to get started:

Review Your Data – Identify where your data lives and where there are gaps. This lays the foundation for smarter integration.

Set Your Priorities – Define the metrics and dimensions that matter most, like revenue by region or by customer type.

Integrate Smoothly – Modern tools connect to your existing systems with minimal disruption. Start with one use case, then scale.

Get Teams On Board – Train users across finance and investment teams to use the data cube for insights and faster decision-making.

Keep Evolving – As your portfolio grows, so should your Data Cube. It is built to flex as your needs change.

Conclusion

In the modern-day, high-stakes private equity environment, where each decision can significantly impact investor returns, outdated reporting methods are no longer suitable.

The Data Cube represents a leap forward, transforming how portfolio data is viewed, analysed, and actioned.

By moving beyond static spreadsheets and siloed systems, private equity firms can unlock a new level of precision, clarity, and agility.

From granular profitability insights to faster due diligence, real-time risk monitoring, and maximised exit strategies, Data Cubes offer a strategic edge.

At iFD, we are committed to helping private equity teams harness the full potential of their data. Whether you are managing five companies or fifty, adopting a Data Cube approach ensures that your decisions are always guided by insight and opportunity.