Cash flow is uppermost in the minds of most CFOs as the current economic headwinds continue to threaten their businesses; now more than ever, cash is king.

Ensuring your business is paid on time is crucial, but often cash flow worries are not because cash flow isn’t optimal; rather, the CFO does not have accurate visibility of where the cash is and when outstanding invoices will be paid.

Consequently, they cannot accurately predict when cash flow could weaken nor proactively take action to avoid a crisis.

Related article | How to manage the flow of cash during economic turbulence

How can technology help CFOs gain a better understanding of cash flow?

In this case study, we share how our ireport team helped our client, a private equity-backed consultancy, use technology to gain a better understanding of their cash collection process:

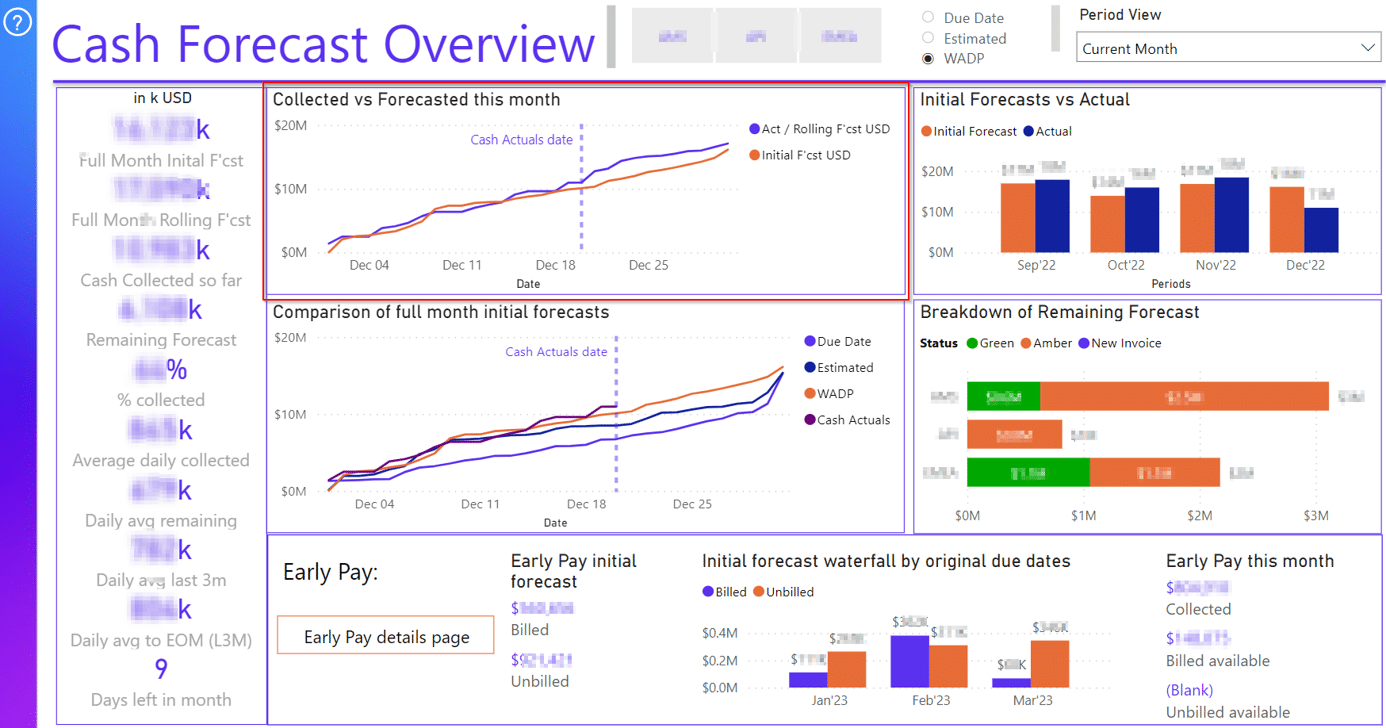

- We used Microsoft Power BI to integrate data from their accounting and time-recording systems

- This gave the team greater visibility through an interactive dashboard of the entire cash cycle from timesheet to invoicing to cash collection

- They were able to view and model the cash collection process:

- Cash receipts in the month

- When outstanding cash is contractually due

- When the credit control team estimate outstanding invoices would be paid based on the client’s payment history

- Finally, they could see the amounts available for early payment if required to keep the cash flowing

They can also see work undertaken but not completed allowing them to forecast cash flow further into the future.

To learn more, please read their story: Case Study | Improving cash collection process with Power BI